In a few sentences

A guide to mastering your money by learning the ins and outs of investments that will allow you to live the lifestyle you want, and achieve financial freedom.

In 7 steps throughout the book, Tony explains in-depth what you should do to achieve the lifestyle of your dreams.

Main ideas

- Take advantage of the power of compound interest.

- Start now! Taking action is the most important step.

- Setting goals for the lifestyle of your dreams can make you realize it is not that far away, it gives you a goal you can plan, calculate and make a reality.

- Don’t try to time the market, time in the market is much more valuable.

- Giving is the key to a life of happiness.

Who should read it

This book is for anyone who wishes to secure his family’s financial future and build financial freedom for life. So… probably everyone.

TAKE ACTION!

The book emphasizes that knowledge without taking massive action will not amount to anything, you must take action with the knowledge you acquire.

Because this book is a 7 step guide of what you need to do, I won’t summarize it here. At the end of the book Tony does it for you, he makes a checklist for all the things you need to do to get started.

The summary

Step 1: Your money of your life! take control

Money is sometimes a taboo subject, but to achieve financial freedom you must master it. You need to start talking more openly on the subject so you can start learning it.

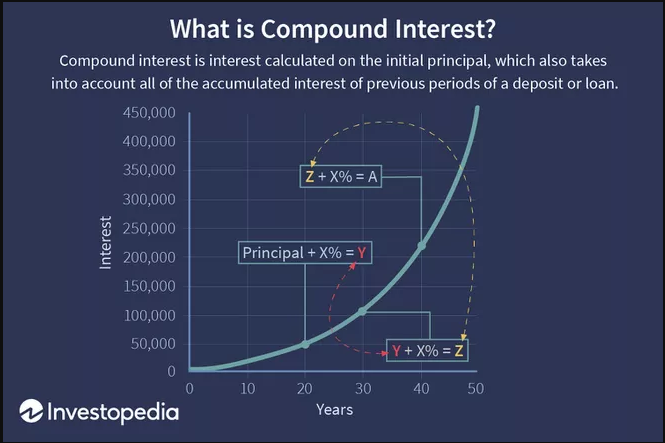

The biggest decision you can make right now is to commit to saving 10% of your annual income, to avoid temptation this should also be done automatically without having even the chance to see the money. The earlier you start saving the faster you will reach your goal. That is because of the power of compound interest.

Step 2: Become the insider, the 9 financial myths that misguide the masses

1# Mutual funds do not beat the market, 96% of actively managed mutual funds don’t beat the market over a long period of time. An index fund, through the years, performs better.

2# Mutual funds may seem like they have small fees, but over an extended period of time, 3.17% a year in fees can be the difference between being able to retire or not.

3# Mutual funds are an advertised product, it often can mislead with its returns its says its brings, when a mutual funds says it has returns of 6% its usually 3%

4# Most mutual fund brokers and managers don’t know what they are doing. Otherwise, they would perform better than the market. It is better to consult a fiduciary.

5# 401K plans benefit from tax deferral but most also come with very high fees.

6# Target date funds are a helpful idea, in theory, the people who put them together operate under two assumptions: bonds are safer than stocks, and bonds and stocks move in opposite directions. Usually, these assumptions are incorrect.

7# Annuities are seen as a bad financial product, but not all annuities are created equal. Most do have high fees, but at least one type is a good investment tool: a tax-free fixed indexed annuity.

8# It is generally believed that to get big returns you need to take big risks. If you manage risk correctly you want to have the potential for a big return while maintaining little risk for your investment. With notes, market-linked CDs, and fixed indexed annuities, you have access to the upside if the market moves the right way while protecting your invested principle

9# The biggest obstacle you have is yourself, your perceptions of the financial world will limit you.

Step 3: Make the game winnable

The real price of your dreams is almost always less than what you think it is. The goal is not to achieve an amount of money, but a lifestyle you dream of. To do that, you must first know the price of it.

The 5 financial goals

Calculate the annual income you will need to reach for each of the financial goals below, after that you will have the price of your dream lifestyle.

- 65% financial Security: housing, food, utilities, transportation, and insurance.

- Full financial security: housing, food, utilities, transportation, and insurance.

- Financial vitality: All of the above + 50% of your monthly expenses on clothing, entertainment, and “small luxury” costs (whatever it may be) – If you achieved this, you’re halfway there!

- Financial independence: you never have to work again, All of the above + 3/2 luxury expenses paid for(boat, vacation, car, etc.)

- Financial freedom: All of the above + anything else you think of, but remember, you can be partial owner or rent and get the same benefits with a fraction of the cost of the things you wish for.

Step 4: Make the most important investment decision of your life

Asset allocation will be the deciding factor of your success, you can lose all your money if you’re not careful where you put your money. Some of the assets you can consider: bonds, treasury bills, gold, stocks, corporate bonds, and annuities.

Have 2 buckets: security bucket and risk/growth bucket. Then, divide the percent you will invest in each bucket, for example: 1000$ = 60% safe bucket 40% growth bucket

Understand the amount of risk you can handle based on your emotional self, and stage in life (the closer to retirement the more safe your investments should be).

Never put all your eggs in one basket, diversification is the key to reducing risk while having the potential of the upside.

Annual rebalancing: Let’s say after 1 year your risk bucket grew and now the balance between the safe and the growth bucket is 30% 70% instead of 40% 60%. Once a year you should balance your investment to your preferred growth/safe bucket split.

Step 5: Create a lifetime income plan

Even when your investments are divided equally between bonds and stocks (50-50), the majority of the risk you take comes from stocks, because stocks are more volatile.

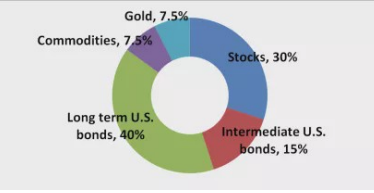

Ray Dalio’s all season’s portfolio who has beaten the market over the past 30 years:

Pair the all seasons portfolio with a good annuity and you’ll have a winning combination for retirement.

Step 6: Invest like the .0001%

The rules of billionaires for investing:

- Don’t lose money.

- Have an asymmetric risk/reward ratio = risk as little as possible to win as much as you can.

- Diversify your portfolio.

- You’re never done, always be in the pursuit of excellence.

In the rest of the chapter Tony interviews many big names in the industry such as: Warren buffet, David Swenson, Jack bogle, and more. You can find the recordings here.

Step 7: Just do it, enjoy it, and share it

This book aims to help you master money, but it is not the answer to happiness which is the ultimate goal. Happiness is also built with relationships and good health. With that in mind, ask yourself the following questions:

- What should I be focusing my time and energy on right now? Focus more on what you have and less on what you don’t. You’ll not only be happier, but you’ll achieve more. Focus on what you can control, not on what you can’t.

- What does money mastery mean for me and my family? Look at the events in your life as the means of a new beginning rather than the end of something old. Once you change the meaning you give things, you begin to change your life as well.

- What am I going to do today to move in the right direction? What you do counts more than what you know. If you want to shape your future, you need to commit to taking necessary action in the preferred direction.

- What can I do today to give to others? Think about what you are most passionate about and determine how you can leave a legacy in that area. Invest in others, this will generate happiness that nothing else can match.

- Investing is not limited to financial instruments, some of the best investments you can make are in experiences, buying time for yourself, and giving to others.

- Progress equals happiness. life is about growing and giving

No matter where you are in life you can become financially free! It may be scary but the best thing you can do is to take action. Start small, slowly but you must start.

Important definitions

- Compound interest: the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods.

- Beating the market: Refers to financial devices performing better than the overall market. the performance of the overall market usually refers to the performance of the S&P 500 index, which tracks the 500 biggest companies.

- Tax deferral: refers to investment earnings that accumulate tax-free until the investor takes constructive receipt of the gains.

- Target date funds: They are funds that are designed to help manage investment risk. You pick a fund with a target year that is closest to the year you anticipate retiring, say a “2050 Fund.” As you move toward your retirement “target date,” the fund gradually reduces risk by changing the investments within the fund.

- Annuities: insurance contracts that provide a fixed income stream for a person’s lifetime or a specified period of time. An annuity can be purchased with a lump sum or a series of payments and begin paying out almost immediately or later in the future. Annuities are often used as a way to fund retirement.

- Tax-free fixed indexed annuity: Interest credited to an FIA is not taxed until clients withdraw those earnings, which can boost savings and increase the potential amount of future income. Keep in mind that the benefits of tax deferral apply only to annuities funded with non-qualified dollars — that is, money on which income tax has been paid.