In a few sentences

The book tells the story of Robert Kiyosaki and how he grew up with his two dads. Rich dad (his best friend’s father) and poor dad (his biological father). Through his stories, he explains the lessons he learned through the years.

It sets you on a path to becoming financially free. It explains how to stop working for money and start making money work for you.

Main ideas

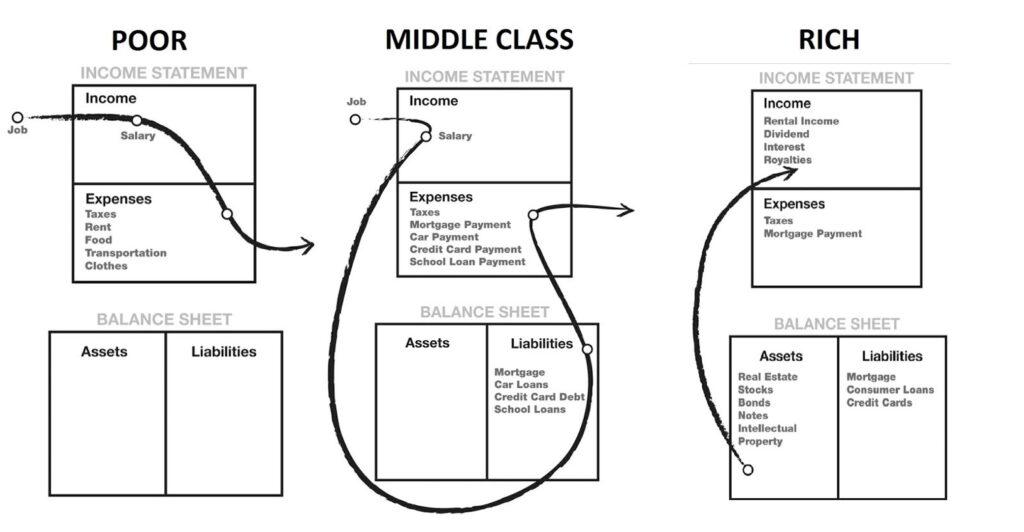

- The poor and the middle-class work for money. The rich have money work for them.

- Rich people acquire assets, while the poor and middle class acquire liabilities they think are assets.

- Financial literacy is a must to become wealthy.

- It’s not about how much money you make, it’s about how much money you keep.

Who should read it

Absolutely everyone, I believe this book can inspire positive change in any who chooses to read and act upon the ideas in the book.

TAKE ACTION!

Start learning! This book is just a start. The most important thing I took from this book is to keep acquiring more knowledge and developing myself.

The summary

"Lesson 1: Rich people make money work for them while the poor and middle-class work for money"

- Fear is the main cause of working for money.

- Rich people make money work for them. A job is a short-term solution to a long-term problem.

- Emotions should not control your thoughts, you need a healthy balance between emotion and reason with your decision-making.

- Money is an illusion. Money is not real, It is only a tool.

"Lesson 2: Become financially literate"

- It’s not how much money you make, it’s how much money you keep. There is no difference between someone who makes 50k a year and spends 40k and someone who makes 120K and spends 110K. They are both left with 10K.

- You need to be financially literate. Master financial literature, “Intelligence solves problems and produces money”.

- Understand what are assets and liabilities, most people confuse those often. Asset: puts money in your pocket. Liability: takes money out of your pocket.

- Cash flow tells the story of your spending.

- The rich buy assets that produce cash flow to pay for their liabilities. the poor and middle class buy more liabilities with their cash flow.

"Lesson 3: Mind your business"

- Acquire assets that you love and understand, it’s much easier to learn them that way.

- Own assets that don’t require your time. Have them managed by other people, if you have to work their its a business, it’s your job, examples: stocks, bonds, Income-generating real estate, notes (IOUs), royalties from intellectual property, anything else that has value, produces income or appreciates, and has a ready market.

- Keep your daily job and start making your assets column grow.

- “If you work for money, you give your power to the employer. If money works for you, you keep the power to control it.”

"Lesson 4: Taxes & Corporations"

What knowledge you should learn:

- Accounting – the ability to read numbers, the more money you manage, the more accuracy you need in managing it.

- Investing – the science of “money making money.”

- Understanding markets – the science of supply and demand.

- The laws of your country(regarding finance).

"Tax advantages"

A corporation can do many things that an employee cannot, like pay expenses before paying taxes. That is a whole area of expertise that is very exciting. Employees earn and get taxed, and they try to live on what is left.

Business Owners with Corporations

- Earn

- Spend

- Pay Taxes

Employees Who Work for Corporations

- Earn

- Pay Taxes

- Spend

Protection from lawsuits

Everybody wants a piece of your action. The rich hide much of their wealth with vehicles such as corporations and trusts to protect their assets. They own nothing but control everything. When someone sues a wealthy individual, they are often met with layers of legal protection.

The poor try to own as much as they can and lose it to the taxes or wealthy citizens.

"Lesson 5: Invent money"

- Great ideas and knowledge are not enough, but you have to take action and be bold.

- The biggest asset you should invest in is yourself, if you develop yourself well you can become wealthy for generations.

- Have fun! We learn by making mistakes. Understand how big a mistake you can endure.

- The main reason most people are not rich is that they are terrified of losing more than they want to win. People who avoid failure also avoid success.

- “It is not gambling if you know what you’re doing. It is gambling if you’re just throwing money into a deal and praying.”

"Lesson 6: Work to learn not for money"

Most people need to learn just one more skill to get rich. Mostly the only single skill that people know is working hard.

The main management skills you need

- management of cash flow (assets and liabilities).

- Management of systems (basic economic theory) political landscape, etc).

- Management of people.

The main specialized skills you need: Sales and marketing – the constant contest over people’s attention and time, and communication skills such as writing, speaking and negotiating.

Becoming a specialist can trap you in a small industry, have a broad knowledge of many areas of your business while having specialists and advisors.

"The obstacles you need to surpass"

The fear of losing money: everyone has that fear, from the richest to the poorest man. the important thing is to know how to manage it. For most people, they fear of losing money more than they enjoy making it.

Cynicism: when everyone is afraid to act, the one who will pull the trigger will be the winner. Doubt and cynicism can cripple and keep poor people poor.

Laziness: never say I can’t afford it, but how can I afford it. This mindset opens your brain to opportunities. How can I afford to never work again?

Bad habits: Our life is a reflection of our habits more than our education. Pay yourself first then the government. When I pay myself first it gives me the motivation to make a higher income, because my creditors(investors, the government, anyone who you need to make money for) will start yelling at me, forcing me to make more income. I make it like lifting weights. A HABIT.

Arrogance: when you see you are arrogant about a subject, that’s when you should educate yourself about it, there is always something you probably don’t know yet.

"Getting started"

- You need a strong reason to make it, if you don’t have one, the road will look long and hard.

- Surround yourself with like-minded people, the people you are around will affect you dramatically, for better or worse.

- Your ability to learn quickly will make your journey much faster.

- Develop self-discipline and build habits to ensure your success.

- Always pay yourself first.